LAWS OF MALAYSIA Act 806 SALES TAX ACT 2018 ARRANGEMENT OF SECTIONS PartI PRELIMINARY Section 1. The RM 7300 in net rental income is subject to a tiered-rate depending on his final statutory income.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited DTTL its global network of member firms.

. Amendment of Acts ChApTERII AMENDMENTS TO THE INCOME TAX ACT 1967 3. Having an adequate number of full time employees and incurred adequate amount of annual operating expenditure in Malaysia for an activity relating to research and development when applyingfor pioneer tax incentive. Amendment of section 6d 6.

Public Ruling No112018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. So if John had made RM 150000 in statutory income inclusive of his net rental income in the case for John his net rental income is subject to a tax rate of 24 which in turn would work out. And b Letting of real property as a non-business source under paragraph 4d of the ITA.

Non-chargeability to tax in respect of offshore business activity 3 C. Special classes of income on which tax is chargeable 4 B. Taxed under the Malaysian Income Tax Act 1967 MITA are taxed under the Labuan Business Activity Tax Act 1990 at 3 of audited net profits or may elect a fixed tax of MYR 20000.

3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment. Lets say John is a tax resident in Malaysia. A new section is added to the income tax act providing that in ascertaining adjusted income no deduction will be allowed in respect of any interest expense in connection with or on any financial assistance in a controlled transaction in excess of the maximum amount of interest as determined under any rules made under the act including interest.

Gains or profits from a business arising from stock in trade parted with. Recognition of office 7. Charge of income tax 3 A.

Income Tax 20182019 Malaysian Tax Booklet 9 Basis of assessment Income is assessed on a current year basis. Functions and powers of Director General and other officers 5. Classes of income on which tax is chargeable 4 A.

Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480. Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

Finance 1 FINANCE BILL 2018 ARRANGEMENT OF CLAUSES ChApTERI PRELIMINARY Clause 1. A company will be a Malaysian tax resident if at any time during the basis year the management and. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

A Letting of real property as a business source under paragraph 4a of the Income Tax Act 1967 ITA. The Income Tax Act 1967 ITA enforces administration and collection of income tax on persons and taxable income. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

See Terms of Use for more information. The Inland Revenue Board of Malaysia IRBM is one of the main revenue collecting agencies of the Ministry of Finance. B Any income derived in relation to exploitation of.

Companies incorporated in malaysia with paid-up capital or limited liability partnerships resident in malaysia with a total capital contribution of myr 25 million or less and that are not part of a group. Short title and commencement 2. 5 December 2018 Page 1 of 39 1.

A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor 2. B deduction of tax from special classes of income. 1 This Act may be cited as the Income Tax Act 1967.

122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. 1 This Act may be cited as the Service Tax Act 2018. 2 This Act comes into operation on a date to be appointed by the Minister by notification in the Gazetteand the Minister may appoint different dates for the coming into operation of different parts or different provisions of this Act.

23 rows The amount of tax relief 2018 is determined according to governments graduated. Meaning of manufacture PartII ADMINISTRATION 4. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

OF THE TAX 3. 20182019 Malaysian Tax Booklet Personal Income Tax 20182019 Malaysian Tax Booklet 23. Objective This Public Ruling PR explains.

Persons appointed or employed to be public servants 6. Amendment of section 4A 6. Amendment of section 12 7.

Reduction of the income tax rate from 18 to 17 on the first myr 500000 of chargeable income of small and medium-sized enterprises ie. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals. Commencement of amendments to the Income Tax Act 1967 4. A New requirements to have substantive tests ie.

Non-business income 4 C. Amendment of section 2 5. The year of assessment YA is the year coinciding with the calendar year for example the YA 2018 is the year ending 31 December 2018.

19 December 2018 1. Objective The objective of this Public Ruling PR is to explain the - a special classes of income that are chargeable to tax under section 4A of the Income Tax Act 1967 ITA. Her chargeable income would fall under the 35001 50000 bracket.

Pincome tax shall be charged upon the income of a person who is a resident which is received in Malaysia from outside Malaysia from 1 January 2022 until 30 June 2022 at the appropriate rate as specified under Part XX of Schedule 1. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. SME It is proposed that the income tax rate on first RM500000 of chargeable income of SME be reduced from 18 to 17.

The longstanding position of the Inland Revenue Board of Malaysia IRB in regard to judicial review applications to challenge tax assessments raised by them is that the appeal procedure under section 99 of the Income Tax Act 1967 ITA is sufficient to address taxpayers complaints. Amendment of section 34 8. December 7 2017 by Conventus Law.

Income Tax Malaysia 2018 Mypf My

Tax Incentives For Research And Development In Malaysia Acca Global

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

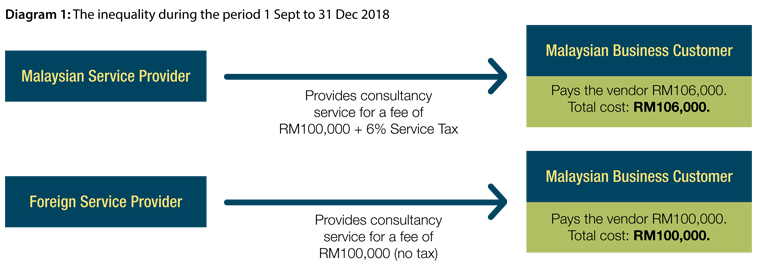

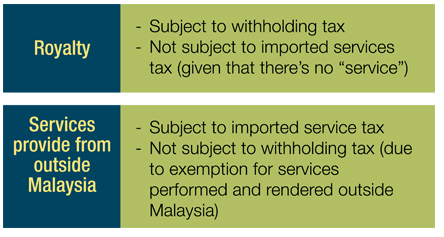

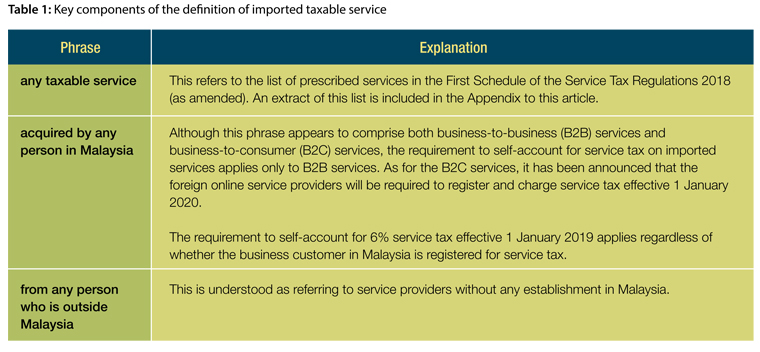

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Income Tax Malaysia 2018 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

Sst Simplified Malaysian Service Tax Guide Mypf My

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Malaysia Sst Sales And Service Tax A Complete Guide

Income Tax Malaysia 2018 Mypf My

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0